My ex colleague, Alan Beattie, has a running thread on Bluesky about President Trump’s trade policy called “Nobody knows anything”. (Itself this is taken from screenwriter William Goldman’s quip about how Hollywood never knows which movies will become hits.) His latest entry cites two new statements from Scott Bessent, the US Treasury secretary.

So is there still scope for negotiation, or is the deadline (a week on Friday) immovable? Trade agreements take years, not days, to negotiate because the devil is in the details.

My latest book, The Economic Consequences of Mr Trump, was published on July 17 (it is available on Kindle in the US). One of the FT’s “best new economics books”, it can be found here https://www.amazon.co.uk/Economic-Consequences-Mr-Trump-Trade/dp/1805227688

The confusion of Mr Trump’s economic policy is a feature, not a bug. There is no coherent strategy so the tactics are also incoherent. Mr Bessent’s statements are simply a reflection of this incoherence. It is tempting to feel sympathy for Mr Bessent, but as with the tale of the frog that was stung by a scorpion to which it gave a lift, Mr Bessent knew Mr Trump’s nature when he signed up for the job.

The markets assume that the recurrent threat of tariffs are merely a negotiating tactic; the tariffs will not be enforced. Investors believe that the President learned his lesson in April when the original round of tariff announcements led to a sell-off in equities, bonds and the dollar. Hence they are calm in the face of the headlines believing that “Trump Always Chickens Out” - the TACO trade as Robert Armstrong of the FT dubbed it.

But there is a double paradox at the heart of this trade. If the markets are calm, why would Trump chicken out? And if investors think it is all a bluff, why wouldn’t the leaders of other countries believe the same? And if they believe that, why would they grant Mr Trump any concessions? The double paradox makes tariffs more likely to be implemented, not less.

Countries like Japan have been negotiating with the US for months. One of the problems for negotiators is that Mr Trump invents barriers to trade that do not exist, such as a supposed “bowling ball test” on cars. The Japanese have struggled to know what the US actually wants.

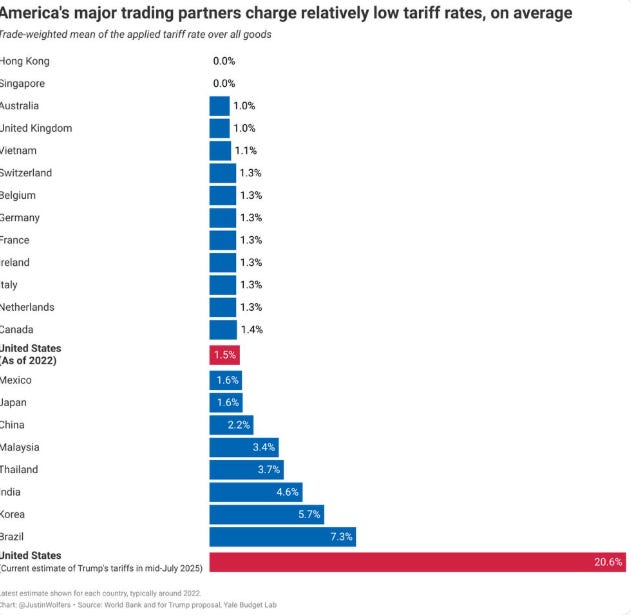

The underlying problem is that other countries can’t cut tariffs since they don’t impose them in the first place, as this chart from Justin Wolfers shows.

The US President clearly wants to declare “victory” so he can justify the trade war to his supporters. Perhaps the best hope, then, is to adapt the strategy of Marlon Brando in the Godfather and make him “an offer he can’t understand”. Make some token concession that doesn’t cost anything but Mr Trump will think is real.

Hence the search for Unicorns, or UNImportant COncessions to Resolve Negotiations. Promise to buy more soybeans or airplanes that the other country was going to buy anyway; remove some regulation that wasn’t really a barrier to trade. If we can find enough of these Unicorns, then the double Taco paradox may be resolved. The best trade negotiators may need a vivid imagination.

UPDATE: Since the piece was written, there has been an announcement of a US-Japan trade deal. Japan will face tariffs of 15%, down from the threatened 25%, but up from the 10% currently being paid. And Japan also found its UNICORN with the plan to invest $550bn in the US. As the FT remarks, Trump made these comments “without providing details of who would make the investment and over what timeframe”.